- The Next Big Rush

- Posts

- ⛏️ Gold Breaks Higher

⛏️ Gold Breaks Higher

PLUS: Ukraine Lithium Stakes

👷♀️ Greetings Contrarian!

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

📝 Here are the highlights

💪 Gold Breaks Higher

🧐 Ukraine Lithium Stakes

🐦 Bullish Uranium Outlook

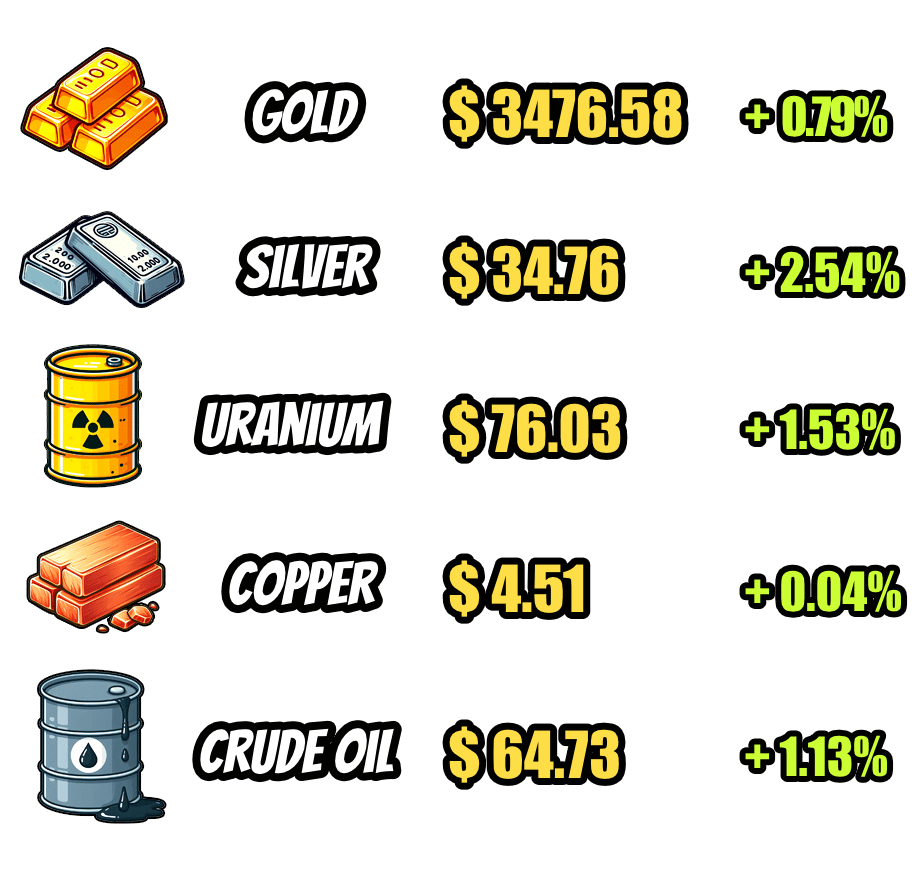

📌 Daily Commodity Prices

Source: TradingEconomics and Numerco.

💪 Gold Breaks Higher

Gold surged to a more than four-month high—spot gold rose 1.2% to $3,486.86 per ounce, reaching levels not seen since April 23, thanks to growing expectations of a Federal Reserve interest rate cut this month, along with a weaker dollar.

U.S. gold futures for December increased 1.1% to $3,554.60. Silver also rallied strongly, climbing 2.2% to $40.56 per ounce, its highest price since September 2011. Analysts cited dovish remarks from San Francisco Fed President Mary Daly and a weakening dollar following legal setbacks to Trump-era tariffs as key catalysts.

The rally was further amplified by thin trading liquidity due to a U.S. bank holiday.

Additionally, platinum and palladium posted gains of 1.5% and 0.8%, respectively.

🧐 Ukraine Lithium Stakes

Ukraine has launched a tender for the Dobra lithium deposit in the Kirovohrad region, offering a 50-year development agreement requiring at least $179 million in investment as part of a new minerals deal with the US.

The move underscores Ukraine’s bid to exploit its under-explored critical mineral resources, which include about a third of Europe’s lithium endowment, while aligning with Western efforts to reduce reliance on China for processing.

However, the project faces legal uncertainty after Critical Metals (NASDAQ: CRML) and its top shareholder, European Lithium (ASX: EUR), claimed rights to the deposit through a disputed licence.

Despite this, US-backed investment firm TechMet and other bidders are preparing offers, with Kyiv stressing the need for not just extraction but also local value-added development.

📰 In Other News

🐦 Bullish Uranium Outlook

💥 #PTAlert#uranium 💥

"Uranium prices are likely to rise to $100/lb next year, says Citi."

Boom #nuclear#smr 🤯

— 🇨🇦 NostraThomas #uranium #nuclear #smr (@SloCan68)

11:04 PM • Aug 31, 2025

How Are We Doing?Today's mining news was: |

Happy Speculating!

The Editor

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

Would you like to update how frequently you receive our emails? 📬

Reply