- The Next Big Rush

- Posts

- ⛏️ Bullion Takes Breather

⛏️ Bullion Takes Breather

PLUS: Castilla Bonanza

👷♀️ Greetings Contrarian!

This is The Next Big Rush, your daily drop of mining and energy investing news. Where we come together and play a few basketball games. 🏀

📝 Here are the highlights

😉 Bullion Takes Breather

👏 Castilla Bonanza

🐦 Beyond Market Mining

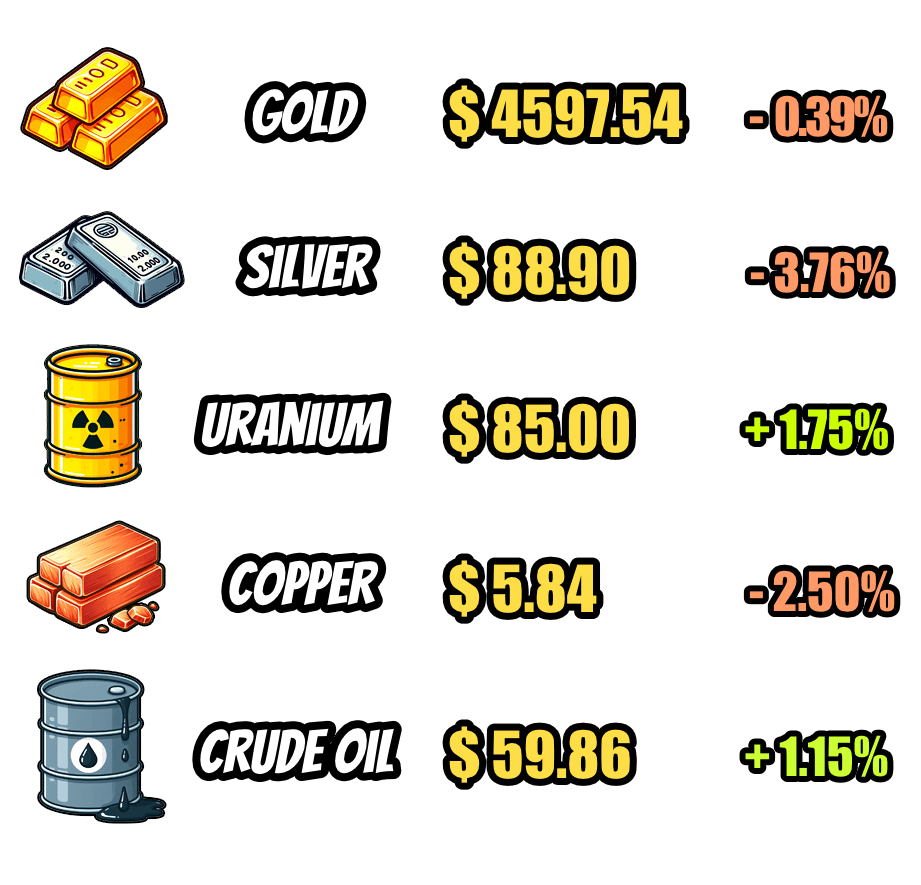

📌 Daily Commodity Prices

Source: TradingEconomics and Numerco.

😉 Bullion Takes Breather

Gold prices eased today as stronger-than-expected US economic data and easing geopolitical tensions in Iran reduced safe-haven demand, with spot gold slipping to around $4,600/oz despite remaining up roughly 2% for the week after hitting a record high.

A firmer US dollar, supported by lower-than-expected jobless claims, weighed on bullion, while high prices dampened retail demand in India and kept buying subdued.

Elsewhere, silver and platinum were also lower on the day but remained on track for solid weekly gains after recent record highs, highlighting that while momentum has cooled, precious metals continue to be supported at elevated levels.

👏 Castilla Bonanza

Super Copper Corp. (CUPR.CSE), reported a bonanza-grade gold and copper surface discovery at the Castilla Copper-Gold Project in the Atacama Region, Chile.

Highlights:

53.8 g/t gold from surface rock grab sampling.

17.7% copper, confirming high-grade sulphide potential.

Over 50% iron in multiple samples, consistent with IOCG-style systems.

Approximately 25% of all samples returned grades above 1.0 g/t gold, indicating property-scale mineralisation rather than isolated anomalies.

The combination of gold, copper and iron, alongside widespread alteration and pathfinder elements, supports the presence of a robust mineralising system and positions Castilla as a potential flagship asset in a premier copper-gold jurisdiction.

📰 In Other News

🐦 Beyond Market Mining

How Are We Doing?Today's mining news was: |

Happy Speculating!

The Editor

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

Would you like to update how frequently you receive our emails? 📬

Reply