- The Next Big Rush

- Posts

- ⛏️ Golden Run Continues

⛏️ Golden Run Continues

PLUS: Silver Breaks History

👷♀️ Greetings Contrarian!

This is The Next Big Rush, your daily drop of mining and energy investing news. Where we come together and have a beer. 🍻

📝 Here are the highlights

💪 Golden Run Continues

😎 Silver Breaks History

🐦 Click, Fund, Fission

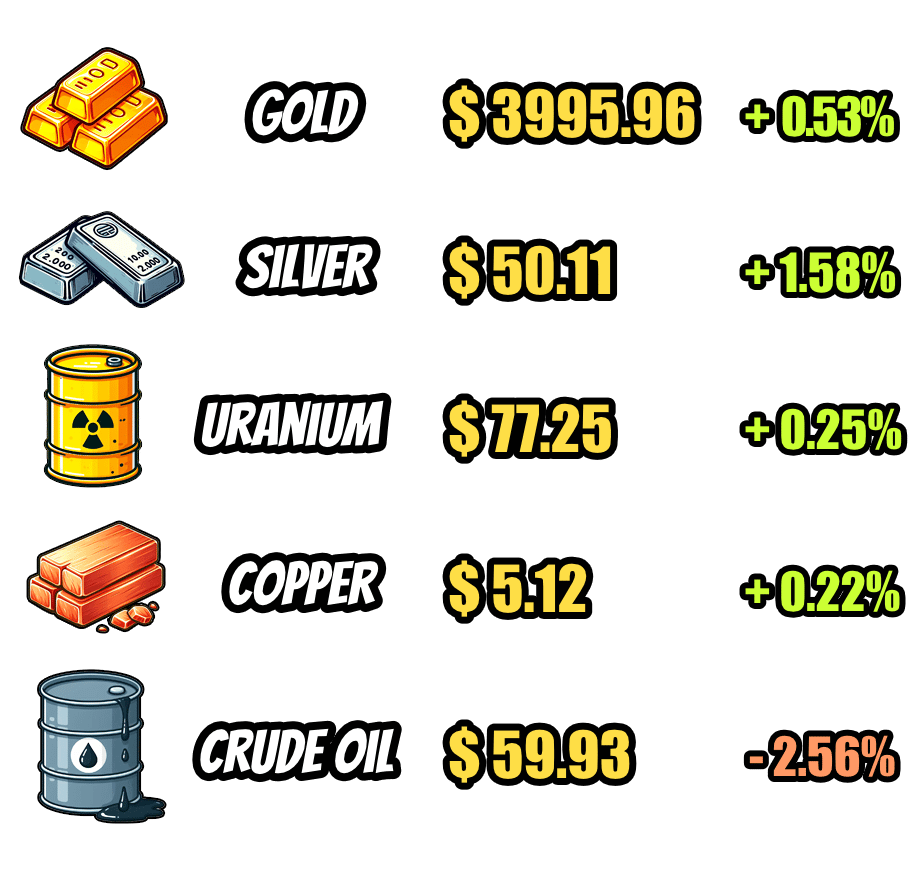

📌 Daily Commodity Prices

Source: TradingEconomics and Numerco.

💪 Golden Run Continues

Gold is set for its eighth straight weekly gain, climbing 2.7% to around US$3,993 per ounce after hitting a record US$4,059 earlier in the week, as investors flock to safe-haven assets amid global uncertainty and expectations of U.S. rate cuts.

Analysts describe gold’s rise as part of a secular bull market, fuelled by geopolitical tensions, central bank buying, ETF inflows, and a weaker U.S. dollar.

Silver also surged, hovering near its record US$51.22 per ounce, up 76% year-to-date, though traders warn of potential short-term volatility.

Platinum and palladium posted modest gains as broader precious metals sentiment remained strong.

😎 Silver Breaks History

Silver surged past US$50 per ounce for the first time since 1980, reaching US$51.23, as investors flocked to safe-haven assets amid fiscal and geopolitical uncertainty.

The rally—up nearly 70% year-to-date—outpaced gold’s gains and reflected both strong investment demand and tightening physical supply, with the silver market in London facing severe shortages and record borrowing costs.

Analysts cite persistent supply deficits, industrial demand from solar and wind energy, and renewed “debasement trade” fears as key drivers.

However, volatility remains high, echoing past speculative surges such as the Hunt brothers’ 1980 squeeze and the #silversqueeze movement of 2020.

📰 In Other News

🐦 Click, Fund, Fission

How can I buy #uranium?

You can buy U3O8 directly through the xU3O8 dApp platform in three steps👇1️⃣ Sign up and create your account (if using Transak - KYC, eligibility questions and a mandatory 24 hour cooling-off period would be required before trading can begin).

2️⃣ Add

— 📐triANGLE INVESTOR (@capnek123)

7:10 AM • Oct 9, 2025

How Are We Doing?Today's mining news was: |

Happy Speculating!

The Editor

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

Would you like to update how frequently you receive our emails? 📬

Reply