- The Next Big Rush

- Posts

- ⛏️ Metals Pull Back

⛏️ Metals Pull Back

PLUS: Uranium Goes Strategic

👷♀️ Greetings Contrarian!

This is The Next Big Rush, your daily drop of mining and energy investing news. Where we come together and take the pups for a walk. 🐶

📝 Here are the highlights

🧐 Metals Pull Back

😎 Uranium Goes Strategic

🐦 Canada’s Atomic Moment

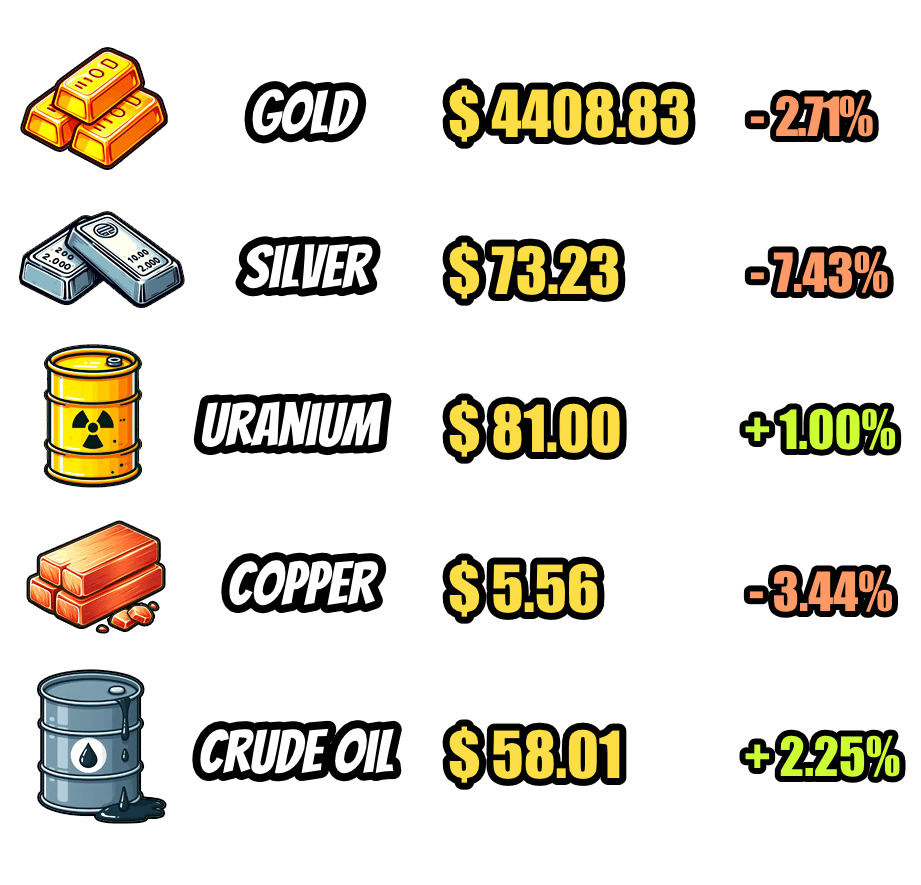

📌 Daily Commodity Prices

Source: TradingEconomics and Numerco.

🧐 Metals Pull Back

Silver pulled back after hitting a new record high of $83.62/oz, retreating about 5% to ~$75/oz, while gold eased 1.7% from near-record levels to ~$4,455/oz as traders locked in profits and safe-haven demand softened amid optimism around potential Ukraine peace progress.

Platinum and palladium also fell sharply after recent peaks, and analysts attributed the declines mainly to year-end profit-taking, with markets now watching upcoming U.S. Federal Reserve meeting minutes for clues on interest-rate policy.

Despite the pullback, gold is up ~72% year-to-date and silver ~181% on the back of softer U.S. monetary conditions, strong central-bank buying, supply tightness and rising investor and industrial demand.

😎 Uranium Goes Strategic

Following a recent U.S. Federal Register notice, domestic uranium producers are being positioned as part of the national defense framework rather than purely market-driven mining companies.

The notice frames U.S. uranium as critical infrastructure, with the government moving to streamline approvals, reduce regulatory delays, and support supply-chain coordination across the nuclear sector.

Through the new UFIRM mechanism, Washington is also signalling price-stability backing to help ensure U.S. uranium projects are not derailed by global price volatility — effectively embedding domestic uranium supply into national security strategy.

If applied correctly, this could be very very big.

📰 In Other News

🐦 Canada’s Atomic Moment

How Are We Doing?Today's mining news was: |

Happy Speculating!

The Editor

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

Would you like to update how frequently you receive our emails? 📬

Reply